One of the primary reasons to consider insurance is to protect yourself against medical emergencies that may occur while engaging in adventurous activities. Accidents happen, and when you’re away from familiar surroundings, medical expenses can quickly accumulate. Adequate travel medical insurance can provide coverage for hospitalization, emergency medical treatments, and medical evacuation if required.

Furthermore, insurance also offers protection against trip cancellations and delays. Adverse weather conditions, natural disasters, or unforeseen personal circumstances can force you to cancel or postpone your trip. With trip cancellation insurance, you can recover your non-refundable expenses and avoid financial losses.

Types of insurance for adventurous travel

When it comes to insurance for adventurous travel, several options cater specifically to the unique risks involved. Understanding these types of insurance can help you make an informed decision based on your needs and preferences.

Travel medical insurance is designed to cover medical expenses incurred during your travels, including emergency medical treatments, hospital stays, prescription medications, and evacuation if necessary. It provides peace of mind, knowing that you’ll receive adequate medical care without facing substantial financial burdens.

Trip cancellation insurance safeguards your investment by reimbursing non-refundable expenses if you need to cancel your trip due to covered reasons such as illness, injury, or unforeseen circumstances. It can also cover additional expenses if your trip gets delayed or interrupted.

Emergency evacuation insurance is particularly crucial for adventurous travelers visiting remote locations or engaging in high-risk activities. It ensures that you will be transported to the nearest suitable medical facility or back home

if you require medical treatment that is not available locally.

Benefits of purchasing insurance

Purchasing insurance for adventurous travel offers several benefits that go beyond financial protection. Let’s explore some of these advantages:

- Financial protection: Insurance provides coverage for medical expenses, trip cancellations, and delays, protecting you from significant financial losses. It ensures that you won’t have to bear the entire cost of emergencies or unexpected events.

- Peace of mind: Knowing that you have insurance coverage gives you peace of mind while embarking on your adventurous journey. Instead of worrying about potential mishaps, you can focus on enjoying your experiences to the fullest.

- Access to assistance services: Most travel insurance plans come with 24/7 assistance services. In case of emergencies or difficulties during your trip, you can reach out to these services for guidance, support, and necessary arrangements. They can assist you with medical referrals, travel arrangements, and other crucial information.

Factors to consider when choosing insurance

When selecting insurance for adventurous travel, certain factors should influence your decision-making process:

- Destination and activities: Consider the specific destination you’re traveling to and the activities you plan to engage in. Some regions or activities may have higher risks, requiring more comprehensive coverage.

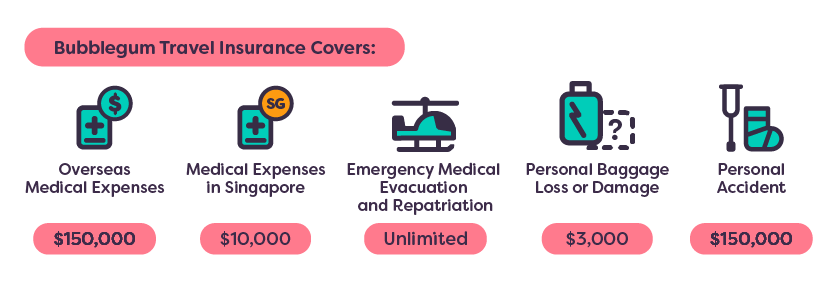

- Policy coverage and limits: Review the policy coverage and limits to ensure they align with your needs. Look for coverage for medical expenses, emergency evacuation, trip cancellations, baggage loss, and personal liability.

- Cost and deductibles: Evaluate the cost of the insurance premium and the deductibles associated with the policy. Balance the coverage offered with the affordability of the plan.

Evaluating personal circumstances

In addition to considering external factors, it’s essential to evaluate your personal circumstances when deciding whether to purchase insurance for adventurous travel:

- Health condition: Assess your overall health condition and any pre-existing medical conditions. Determine if you require additional coverage for existing conditions or if there are any exclusions in the insurance policy.

- Value of the trip: Consider the financial investment you’ve made in your adventurous trip. If it involves significant expenses, insurance can help protect your investment.

- Risk tolerance: Evaluate your personal risk tolerance and the level of comfort you have with potential financial losses. Insurance can provide peace of mind for those who prefer to minimize risks.

Common misconceptions about travel insurance

There are a few common misconceptions surrounding travel insurance that are important to address:

- “I already have health insurance.”: While you may have health insurance coverage domestically, it might not extend to international travel or cover specific adventurous activities. Travel insurance provides additional coverage specifically tailored for travel-related risks.

- “It’s too expensive.”: The cost of travel insurance varies depending on factors such as destination, duration, coverage limits, and age. However, compared to the potential expenses of medical emergencies or trip cancellations, the cost of insurance is generally reasonable.

- “Nothing will go wrong.”: It’s natural to be optimistic about your travels, but unforeseen circumstances can arise at any time. Having insurance provides a safety net in case something unexpected occurs.

Conclusion

When planning an adventurous trip, purchasing insurance is a wise decision that can offer financial protection, peace of mind, and access to necessary assistance services. By considering factors such as destination, activities, personal circumstances, and debunking common misconceptions, you can make an informed choice regarding the insurance coverage you need.

FAQs

- Is travel insurance mandatory for adventurous travel? Travel insurance is not mandatory but highly recommended for adventurous travel due to the potential risks involved.

- What does travel medical insurance cover? Travel medical insurance typically covers emergency medical expenses, hospitalization, medication, and medical evacuation

- if you require treatment that is not available locally or if you experience a medical emergency during your trip.

- Does travel insurance cover extreme sports and activities? Many travel insurance policies offer coverage for a wide range of sports and activities, including some extreme sports. However, it’s important to review the policy details to ensure that your specific activities are covered.

- Can I purchase insurance after booking my trip? In most cases, you can purchase travel insurance even after booking your trip. However, it’s recommended to buy insurance as early as possible to ensure coverage for trip cancellations and any pre-trip emergencies.

- Are adventure sports covered by regular travel insurance plans? Some regular travel insurance plans may include coverage for certain adventure sports, while others may require an additional premium or specialized coverage. It’s crucial to check the policy terms and conditions to confirm coverage for your desired activities.

By purchasing insurance for adventurous travel, you can enjoy your thrilling experiences with confidence, knowing that you have taken proactive steps to protect yourself from potential risks. Remember to thoroughly research and compare different insurance options to find the best coverage that suits your needs and provides the necessary peace of mind throughout your adventurous journey.